Welcome to this HP Site Flow whitepaper on print automation. This is part of a series of whitepapers commissioned by HP in 2020 and provide a thorough independent analysis of current workflow trends and the benefits that it can bring across verticals. From saving hard cost with smart batching and optimisation to scaling to thousands of orders without falling apart, this series is designed to help any print service provider get the full picture. The whitepapers can be read in full on this site or downloaded instantly as a PDF with no pesky forms to fill out. From all of us in the HP Site Flow team, we hope you find the series useful.

Future-Proofing Your Printing Business | Strategies for Leveraging Automation to Enhance Performance

- Future-Proofing Your Printing Business | Strategies for Leveraging Automation to Enhance Performance

- INTRODUCTION

- RESEARCH METHODOLOGY

- ACTIONS FOR IMPROVING OPERATIONS

- FACTORS CREATING BOTTLENECKS

- BOTTLENECK AREAS VARY BY LEVEL OF AUTOMATION

- CONCLUSION

INTRODUCTION

Automating print production workflows offers printing companies many tangible benefits that influence productivity and profitability. Automation enables print providers to improve their company’s financial health, optimize production task execution to improve efficiency, expand product offerings, improve speed to market, scale investments to match growing operations, and expand into new segments. The extent to which a business is automated has a strong influence on how likely it will be to reach its sales and profitability goals. A key benefit of automation is that it breaks bottlenecks: the inefficiencies and constraints of manufacturing that hamper productivity and profits.

Looking to quantify workflow automation advantages, NAPCO Research surveyed commercial printers in the United States, Canada, and United Kingdom. A primary objective of the survey was to find out how print providers are pursing automation and the results it is delivering.

The survey research is summarized in two research reports. This report looks at how printers are using workflow automation to integrate, optimize, and future proof their processes, including breaking the bottlenecks that hamper production. The other report highlights the operational and business benefits automation is delivering to print providers.

Automation Improves Results

Survey respondents vary in terms of automation levels, but most describe pressure to reduce production bottlenecks and improve efficiency. Highly automated firms report having more success than less automated ones in getting rid of their bottlenecks – and in reaping the rewards that come with doing so. The survey found that in general, the more automation that respondents said they had, the less prone they were to see bottleneck-producing factors as likely to slow their operations down. Those survey participants that invest in automation indicate improvements in financial results as respondents reporting higher levels of automation report generating more revenue than respondents with medium- and low-automation.

In addition, respondents with more highly automated operations reported a higher incidence of pursuing actions that are highly beneficial to their organization’s growth and success.

Key Strategies and Tactics for Leveraging Automation

Here is a summary of key research findings:

• Even a modest degree of automation goes a long way in improving production speed and productivity.

• Respondents reporting higher levels of automation are more likely to invest in software than respondents reporting less automation.

• Survey participants with highly automated workflows report producing more jobs per day than respondents with less automation. High throughput links directly to profitability because it minimizes non-chargeable plant time.

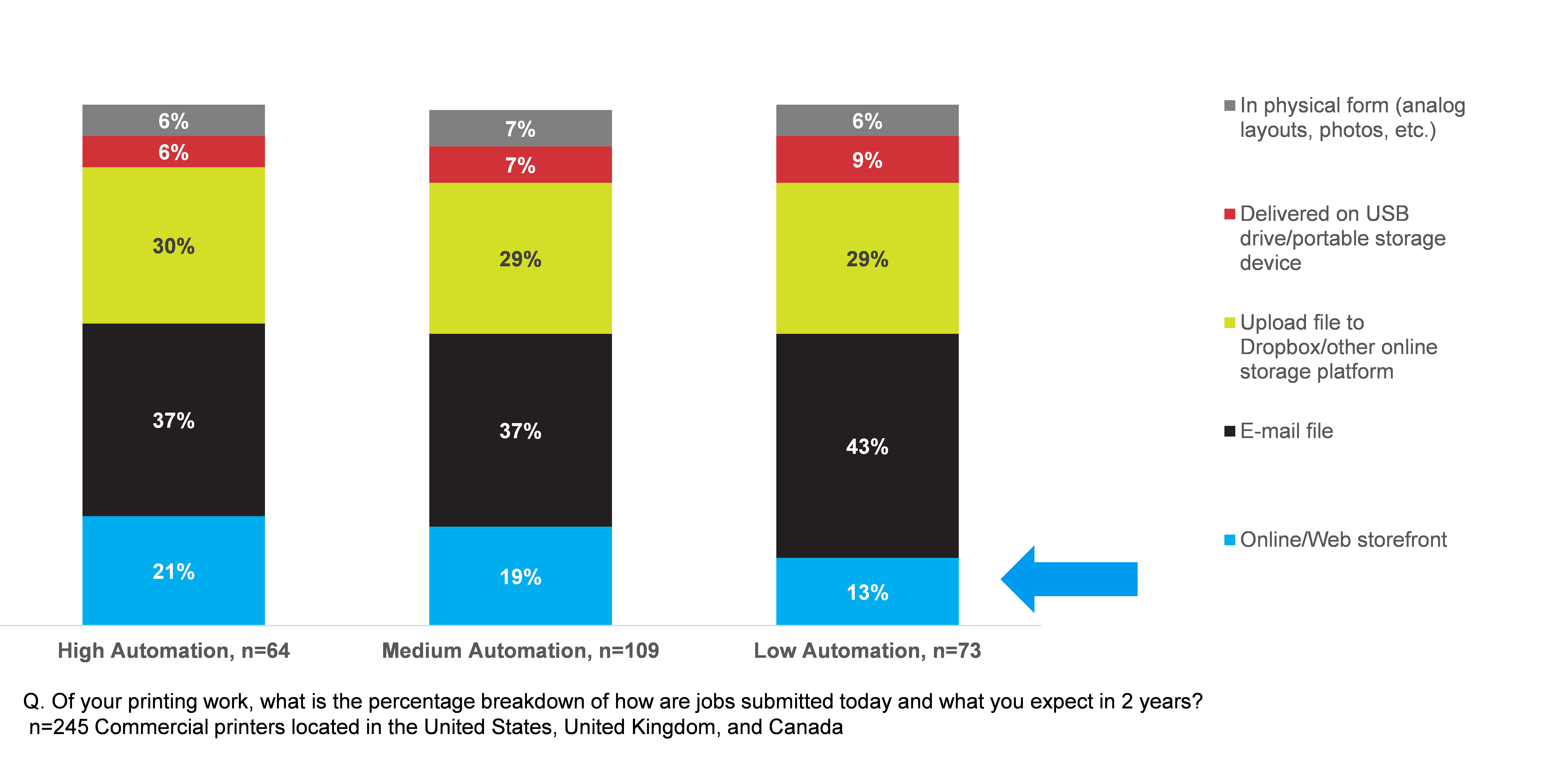

• Respondents reporting higher levels of automation accepted more jobs from customers via online submission portals compared to those reporting less automation. Online print job submission is an essential step in workflow automation.

• The factors seen as most potentially problematic with regard to bottlenecks was relying on expensive labor or high-touch processes. Given that reducing labor expense and eliminating needless touches are exactly what workflow automation is meant to accomplish, this finding alone underscores the wisdom of adding more automation wherever the need for it exists.

• Overall, respondents report that producing and managing a high number of small jobs was unlikely to create bottlenecks. This indicates that the industry is learning how to cope with the decline of long print runs and the rise of on-demand production in small quantities.

Investments in Automation Power Profits

Holding back investment in automation means holding back growth potential – a mistake that no printing business can afford to make in an environment where growth and profit increasingly belong to the most efficient producers.

The main takeaway from the research is automation works, and that for the most part, printers know it works. The perception of value is already there. What’s needed is broader adoption so that there are no longer any high-, medium-, and low-automation printing businesses: only companies taking full advantage of all the benefits workflow automation offers them.

RESEARCH METHODOLOGY

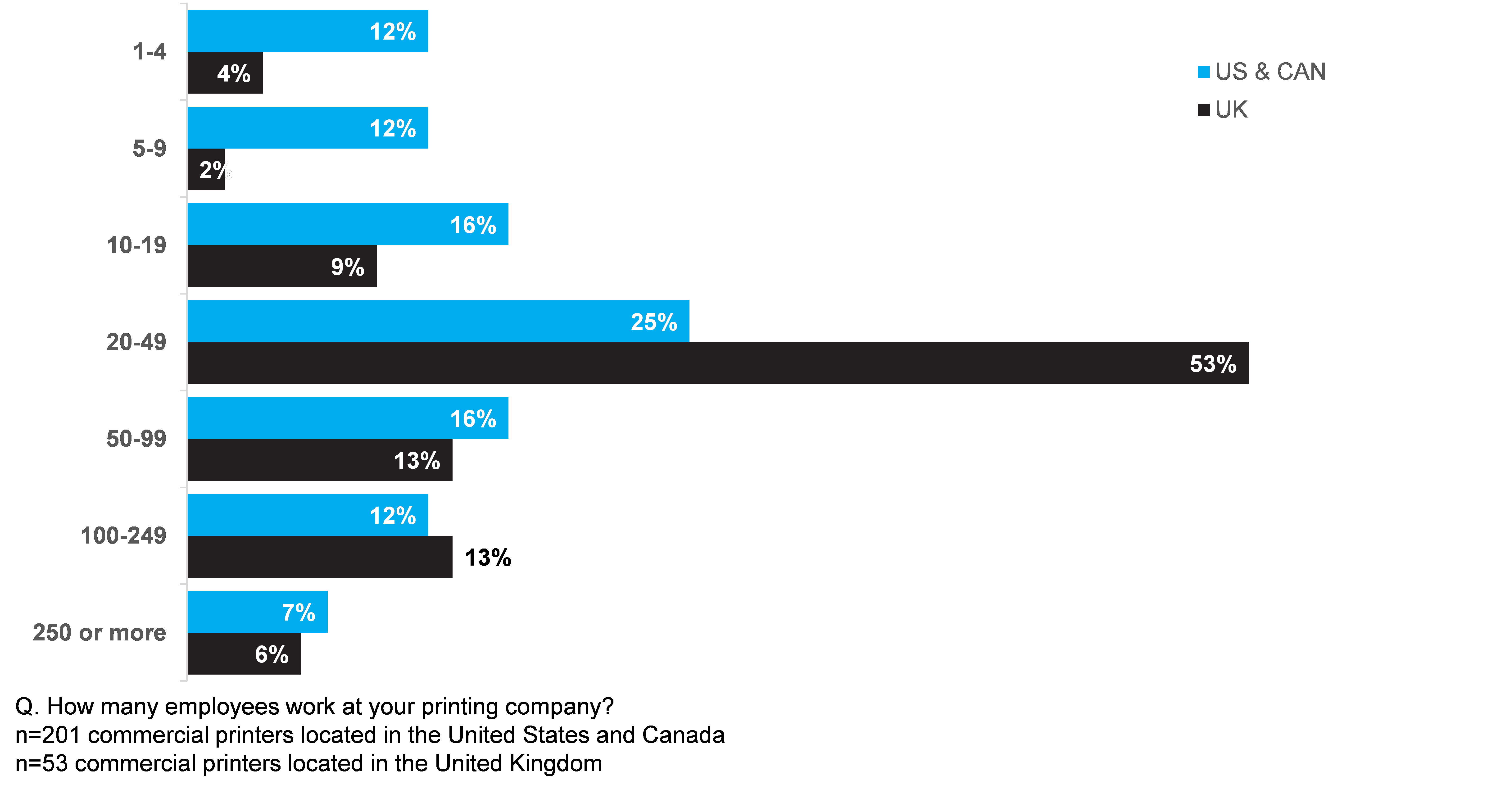

NAPCO Research (a unit of NAPCO Media LLC, the publisher of Printing Impressions) surveyed commercial printers in North America and United Kingdom. The surveys captured responses from 201 commercial printers in North America, nearly all of which are located in the United States, and 53 commercial printers in the U.K.

Classifying Respondents’ Level of Automation

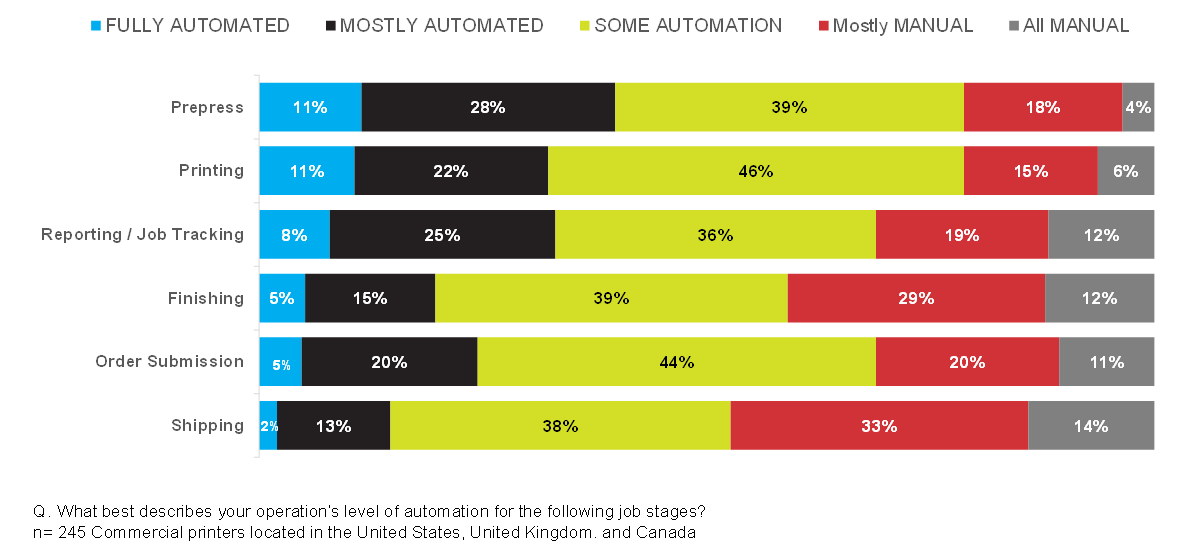

Because a main research goal is uncovering the benefits that workflow automation offers print providers, survey responses were segmented by their organization’s level of automation. The survey asked respondents to rank their company’s degree of automation (fully automated, mostly automated, some automation, mostly manual or all manual) across key job stages from order submission through job shipping (Figure 1).

Although most respondents report some level of automation across the various stages of production, relatively few said they had achieved full automation from end to end. The responses also indicate that significant amounts of work are still being done either mostly manually or entirely manually at all stages. This suggests opportunity to extract greater benefits from automation by investing more in automation.

Figure 1: Level of Automation Across Job Stages

Based on their ranking for each job stage, all 254 respondents were scored and classified in one of three categories: high automation, medium automation, and low automation. Each job stage was weighted equally in scoring automation levels. Segmenting survey responses by levels of automation revealed the following breakouts: • High Automation 28% • Medium Automation 43% • Low Automation 29%

These respondent segments are the foundation for evaluating the benefits and advantages printing operations are experiencing through workflow automation.

Respondent Profiles

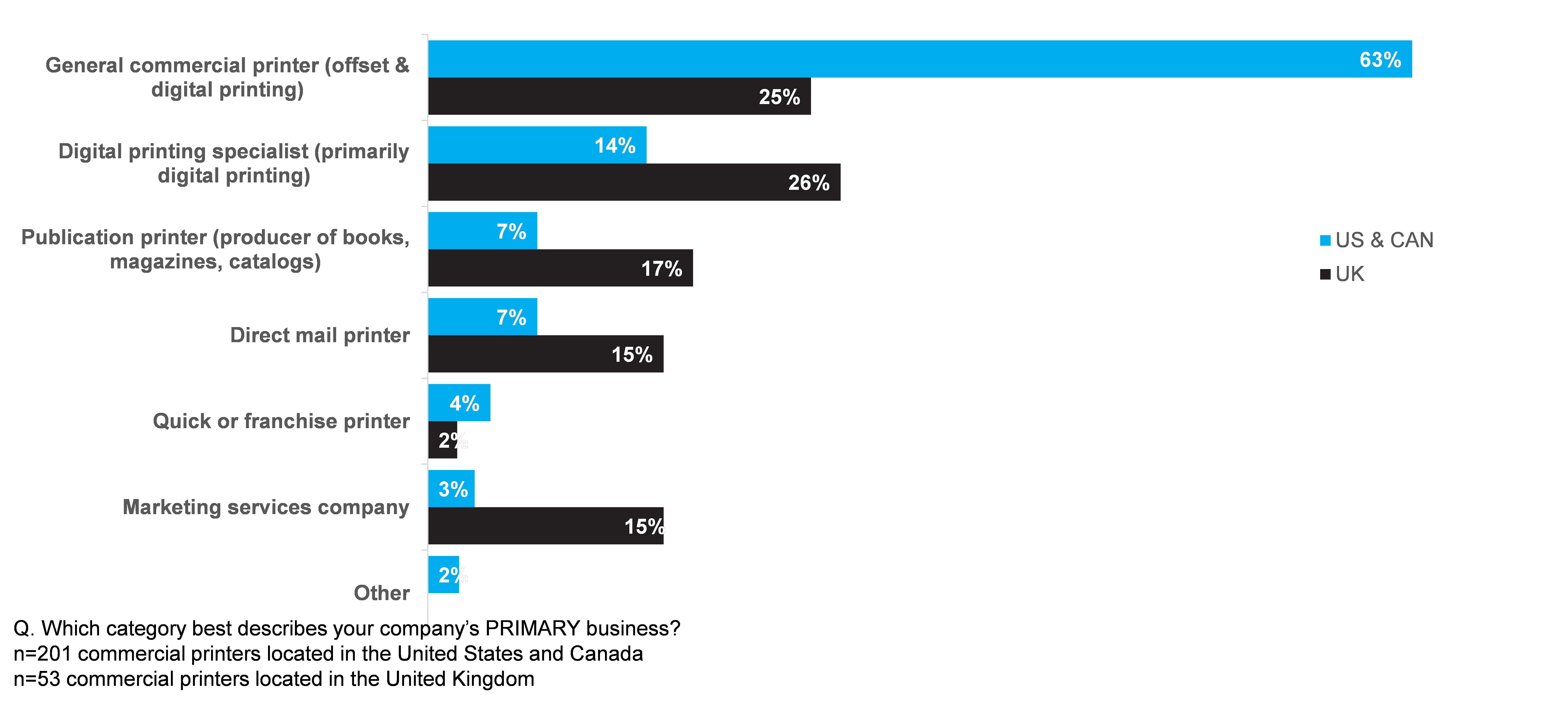

Nearly two-thirds (63%) of the U.S. respondents described their primary business as general commercial printing, including offset and digital (Figure 2). Fourteen percent identified themselves as digital printing specialists, with the remainder indicating publications (7%), direct mail (7%), quick printing (4%), or marketing services (3%) as their primary lines of business.

Among the U.K. respondents, about equal percentages said they were either general commercial printers or digital printing specialists (25% and 26% respectively). The rest are concentrated in publications (17%), direct mail (15%), quick printing (2%), or marketing services (15%).

Figure 2: Primary Business

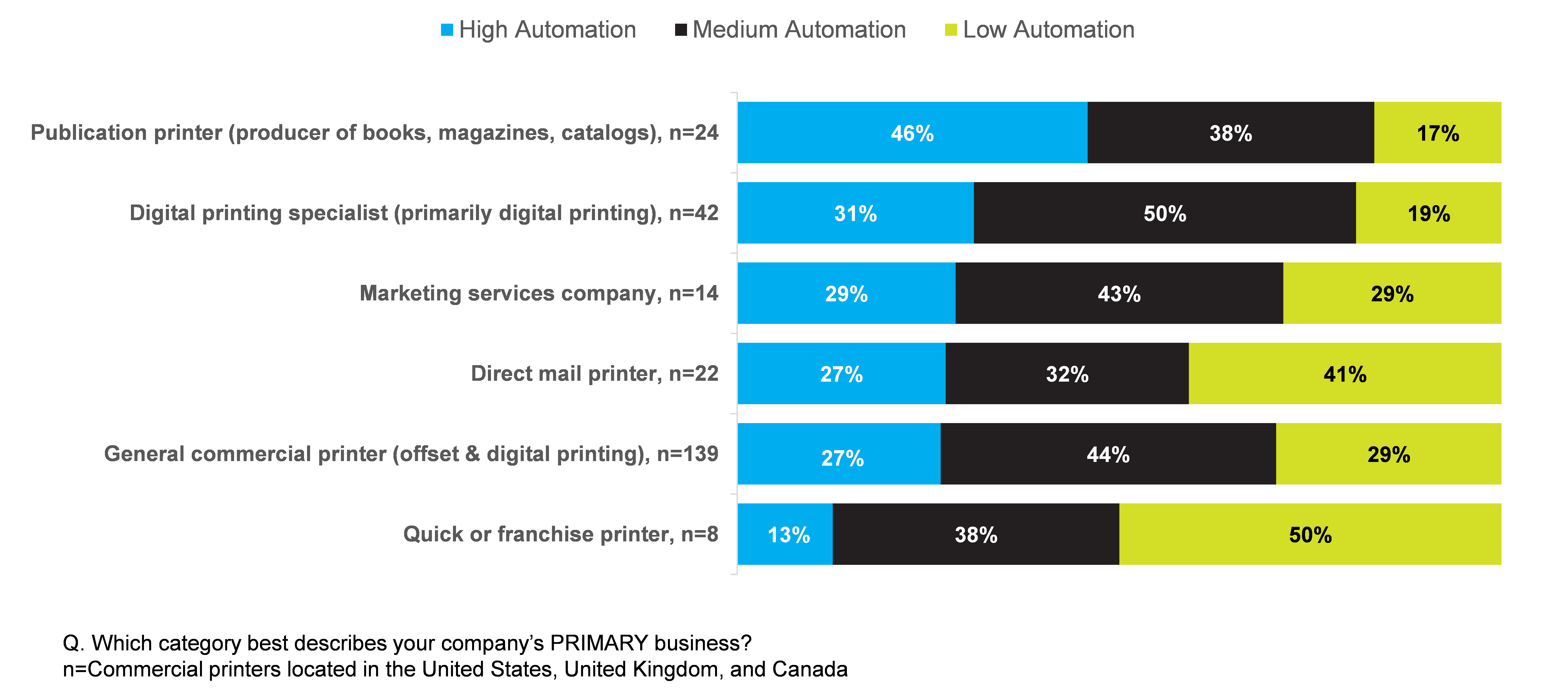

Segmenting types of printing providers by level of automation offers insights into which types of providers have embraced workflow improvements, and which providers can still harness opportunity from it.

Figure 3: Automation Level by Type of Printer

Publication printers report the highest levels of automation, followed by digital printing specialists. These segments also reported having the least number of respondents representing organizations with low automation.

Size of Company

More than two-thirds (65%) of U.S. respondents employed fewer than 50 people; 15% employed 50-99; 12%, 100-249; and 7%, 250 or more (Figure 4). Similar to the U.S., more than two-thirds of U.K. respondents (68%) employ from one to 49 people; 13% employ 50-99; another 13%, 100-249; and 6%, 250 or more.

Figure 4: Number of Employees

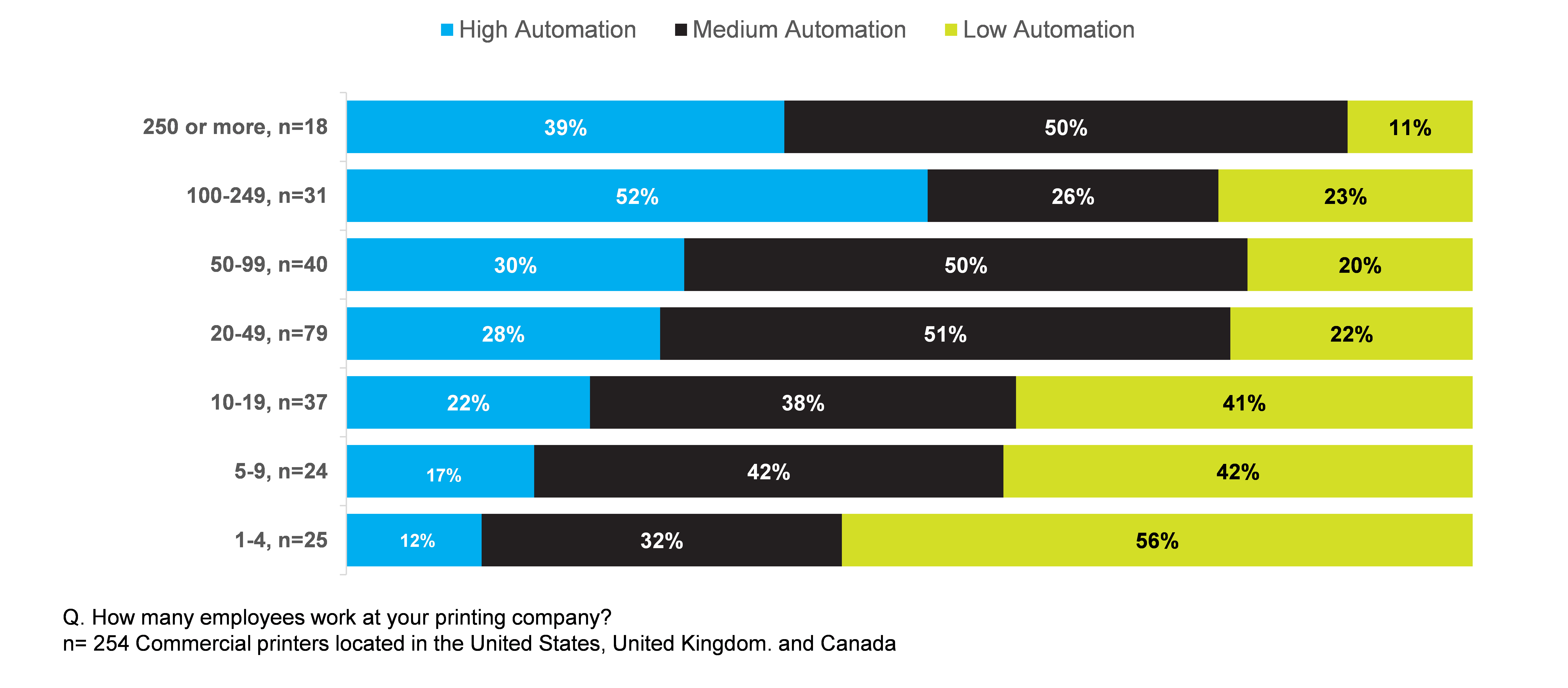

Looking at the size of respondents’ organizations by level of automation shows that larger respondents typically are more automated than smaller firms. Likely reasons are that they have more money to invest, and have much to gain from automation in the form of enhanced efficiency, productivity, and profitability.

Figure 5: Automation Level by Size of Respondent’s Company

ACTIONS FOR IMPROVING OPERATIONS

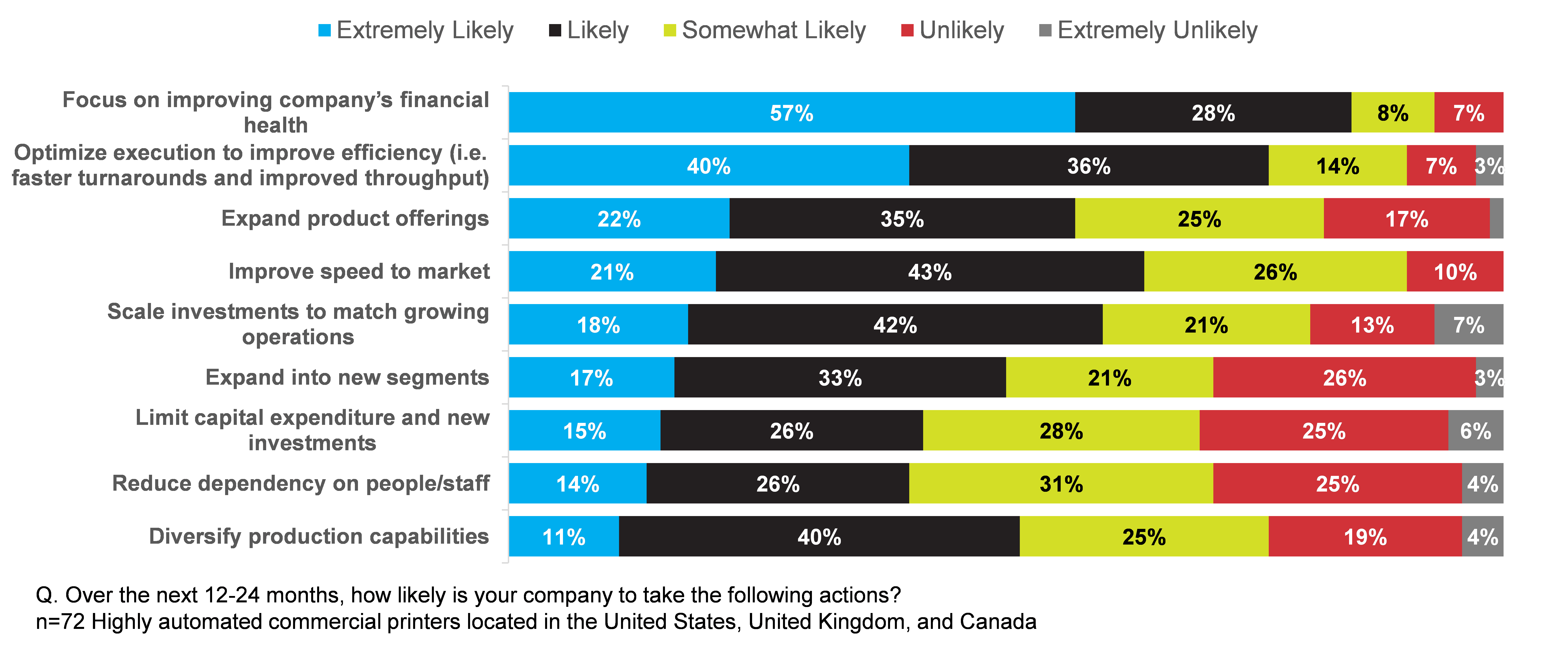

A majority of highly automated firms participating in the survey report their organizations plan to improve their company’s financial health, optimize production to improve efficiency, expand product offerings, improve speed to market, scale investments to match growing operations, and expand into new segments (Figure 6). A top planning priority for 85% of respondents (extremely likely/likely) from highly automated firms is to focus on improving their company’s financial health. A comparable number (76%) said they intended to do it by optimizing execution to improve efficiency – a goal directly supported by leveraging workflow automation.

Figure 6: Actions Highly Automated Firms are Taking

Over half (57%) said they could foresee scaling their spending to keep pace with the growth of their operations. This suggests confidence on their part in achieving a steady return on their investments in better performance.

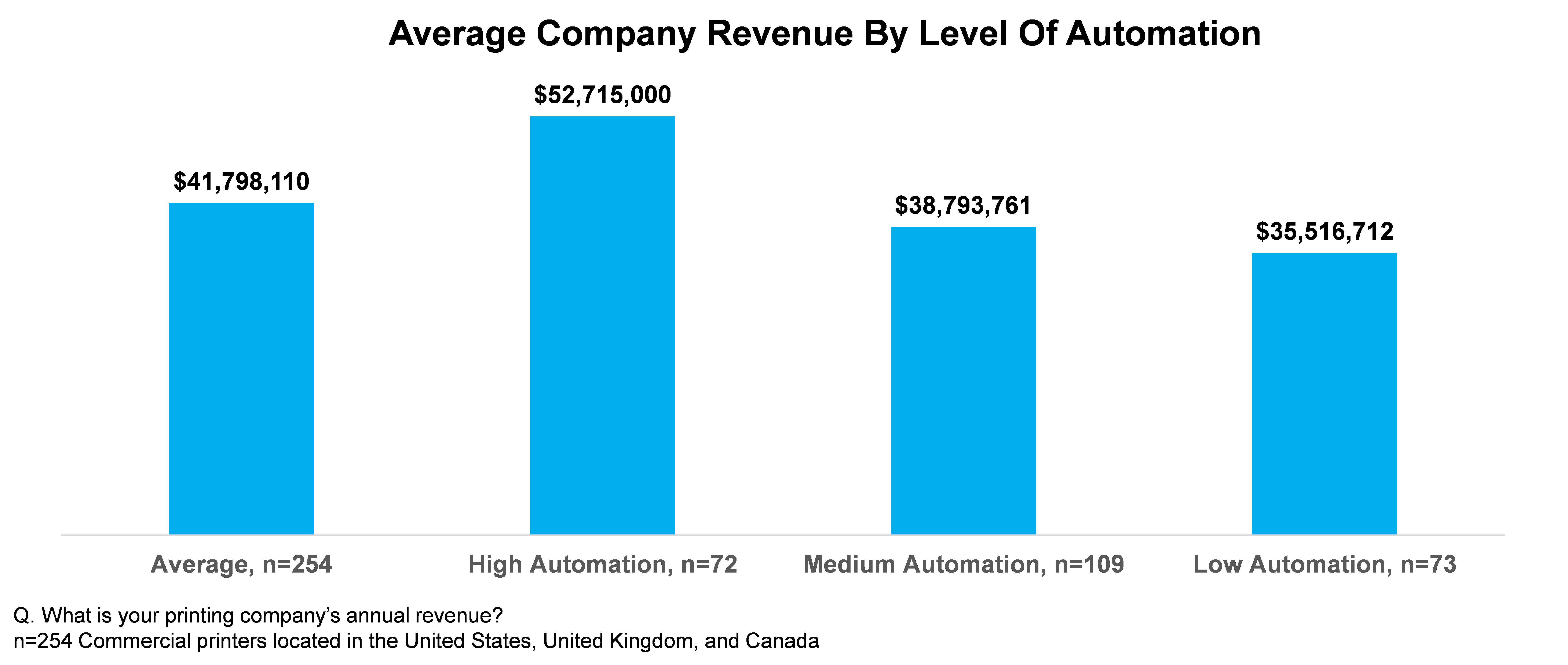

Respondents report that print automation can improve financial results. According to the survey, high-automation firms generate more revenue than medium- and low-automation firms. In this survey, the automation leaders earned 26% more than the average across all levels of automation (Figure 7). Also noteworthy is that medium-automation firms barely outperformed low-automation firms in average annual revenue; an indication that partial investments in workflow optimization may deliver only partial results.

Figure 7: More Automated Companies Report Higher Revenue

Automation Is the Enabler

Comparing responses to questions on future business plans by level of automation indicates that those respondents with more highly automated operations are more likely to be pursuing actions that are highly beneficial to their organization’s growth and success.

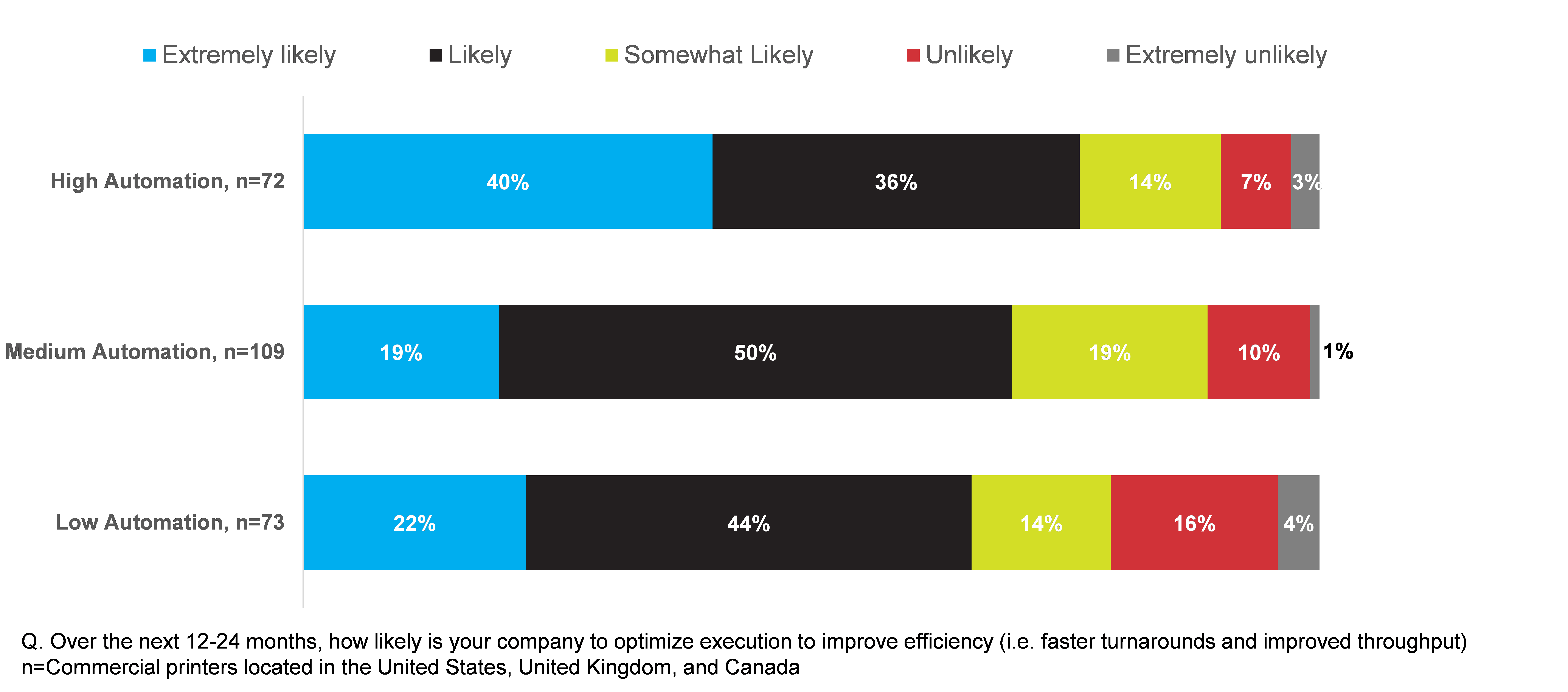

This is apparent when comparing their responses to the question about the likelihood of optimizing execution to improve efficiency (Figure 8). The percentage of highly automated printers saying they were extremely likely to achieve this (40%) was roughly double that of medium automation firms (19%) and low automation (22%) firms giving the same answer.

Figure 8: Likelihood of Optimizing Execution Efficiency

At the other end of the scale, low automation firms said they were unlikely or extremely unlikely to optimize execution at double the percentages of the medium- and high automation firms (20%, 11%, and 10% respectively). Clearly, when it comes to strengthening the performance of printing companies, the more automation in the plant, the more faith in the outcome.

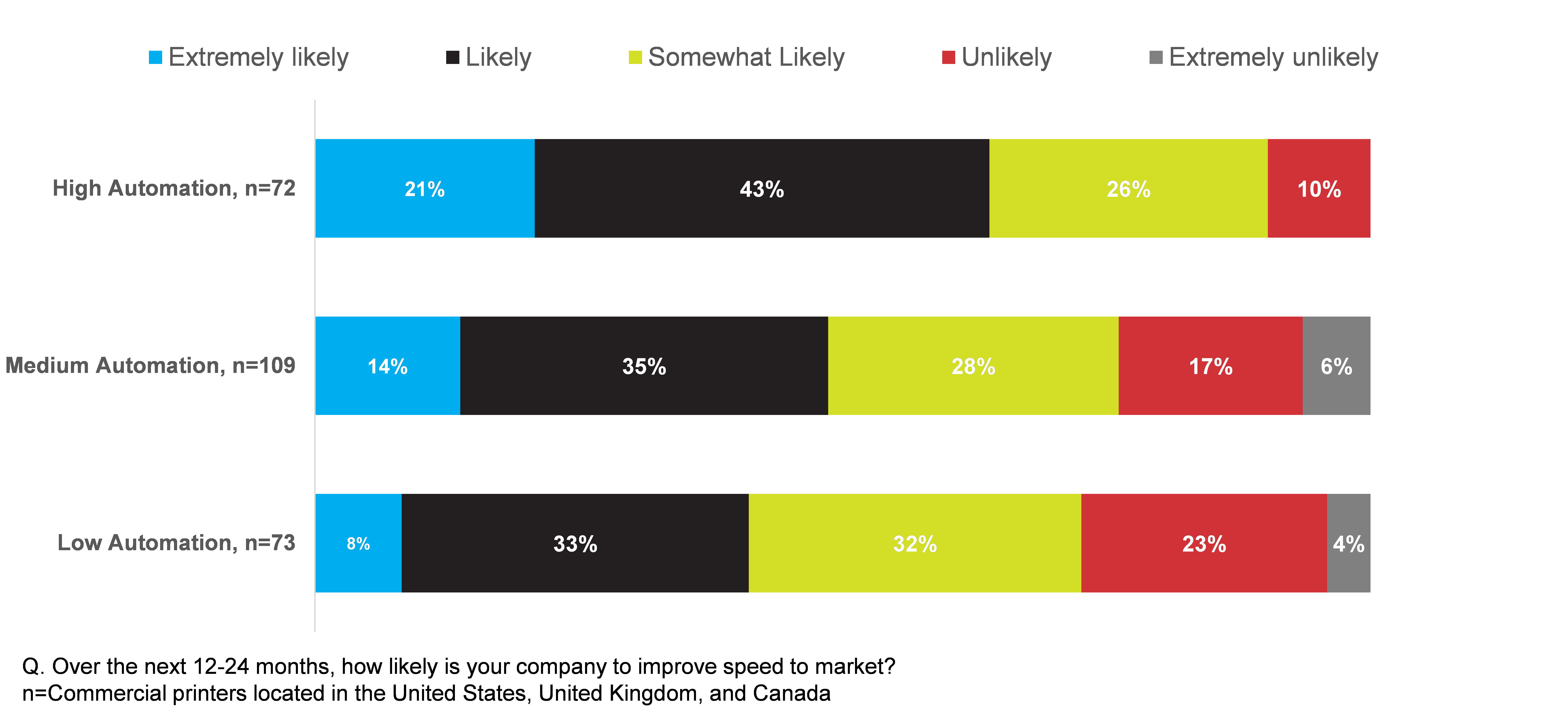

A Little Goes a Long Way

The divergence isn’t as wide among the responses about improving speed to market, with 90% of highly automated firms, 77% of medium automation firms, and 73% of low automation firms expecting success to be likely, somewhat likely, or extremely likely (Figure 9). One takeaway may be that even a modest degree of automation goes a long way to getting work out the door faster – an important point for printers just starting out on their journeys toward process and workflow optimization to consider.

Figure 9: Likelihood of Improving Speed to Market

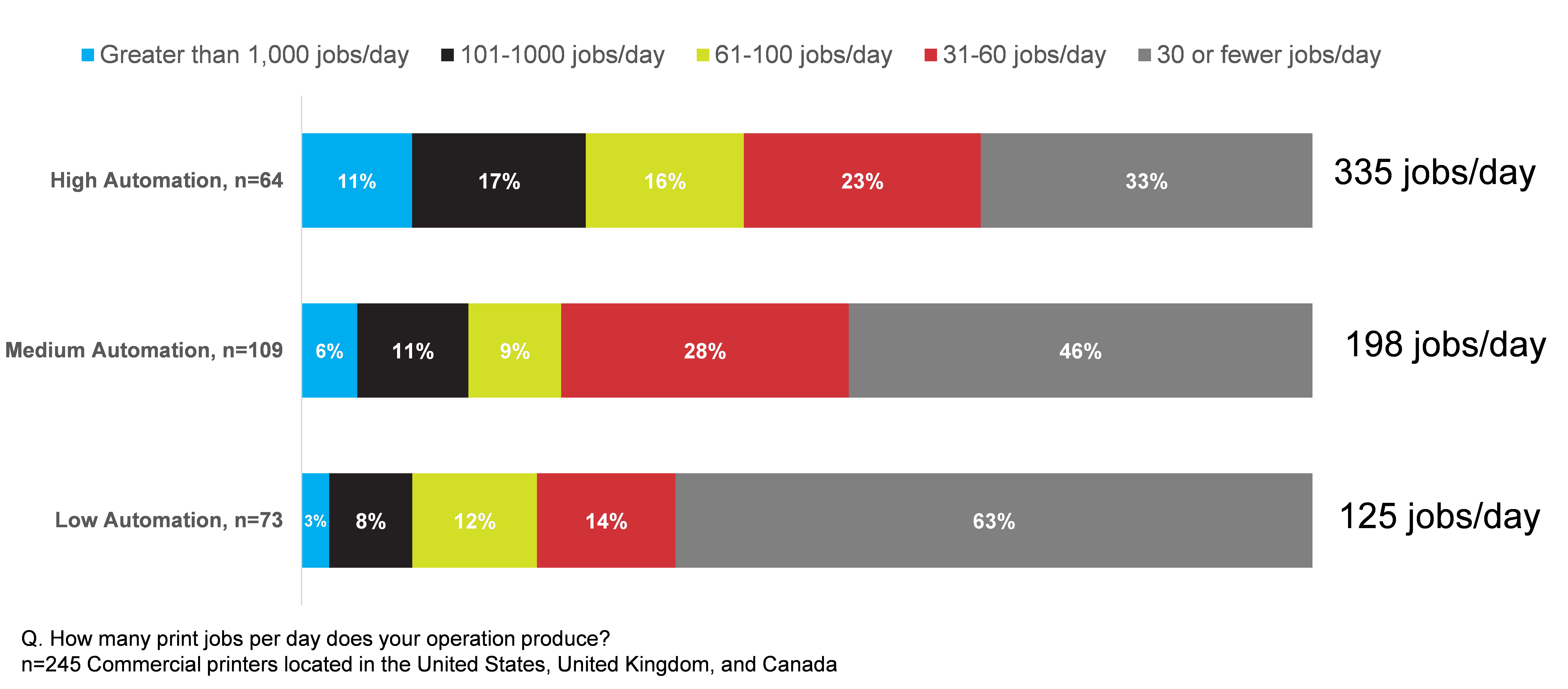

Survey participants with highly automated workflows report producing more jobs per day than respondents with less automation. Respondents with highly automated workflows reported, on average, producing 335 jobs/day: more than two and a half times the output of those with low automation, who produced 125 jobs/day. High throughput links directly to profitability, as it demonstrates that the plant is holding non-chargeable time to a minimum.

Figure 10: More Automation Means Higher Throughput

Investment in Software to Support Automation

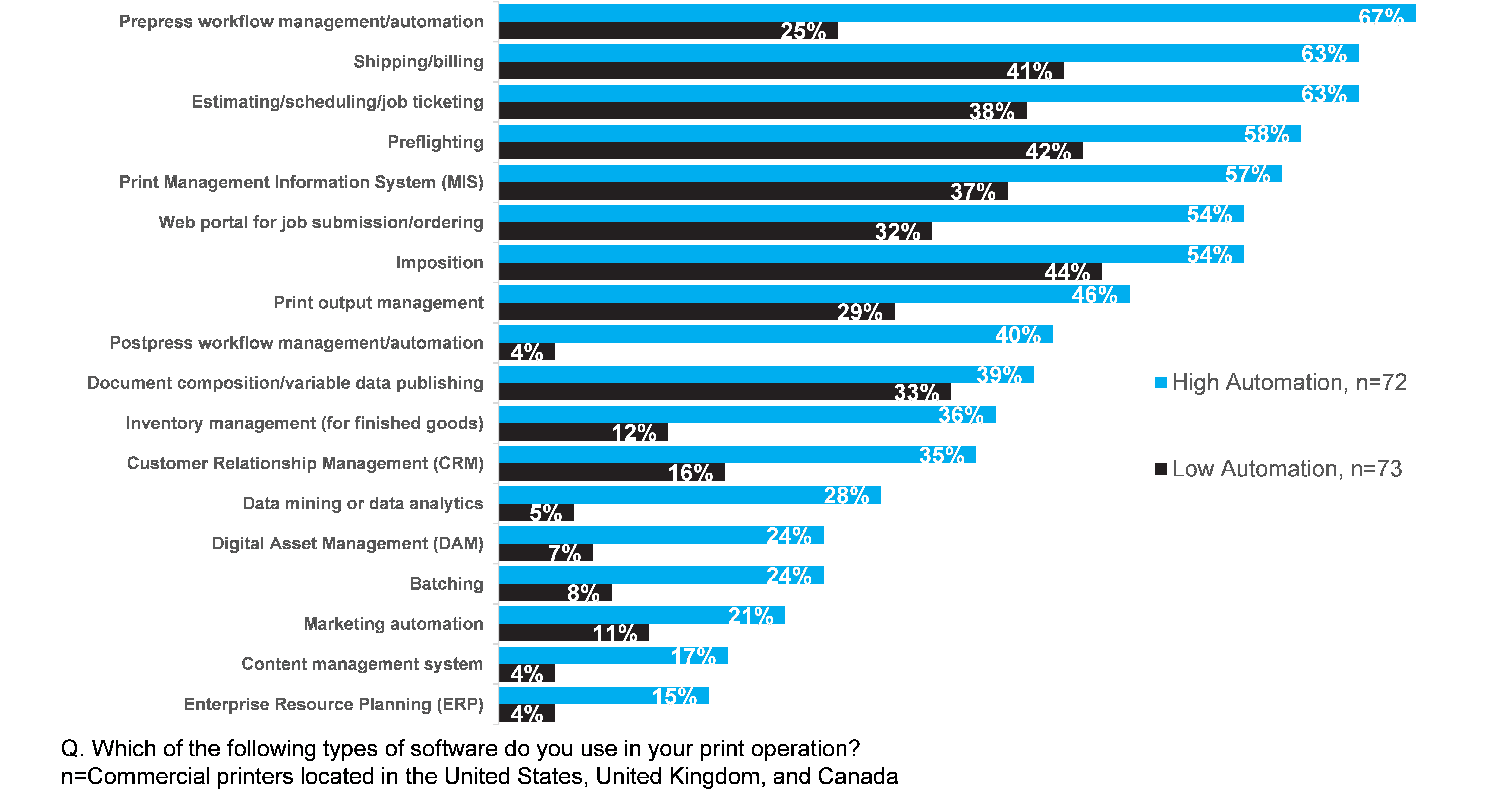

Respondents reporting higher levels of automation were more likely to invest in software than respondents reporting less automation. As shown in Figure 11 highly automated respondents invested more in software. Over half of highly automated respondents invested in software to manage/automate prepress workflow, handle shipping/billing, estimate/schedule jobs, preflight work, support managing operations, submit jobs via online portals, and impose print work.

Figure 11: Software Investment: Highly Automated Firms vs Low Automation

Another software area pursued by highly automated firms is online portals or storefronts to enable customers to submit print jobs. Online print job submission is a key step in workflow automation. Respondents reporting higher levels of automation accepted more jobs from customers via online submission compared to those reporting less automation (Figure 12).

Figure 12: Print Job Submission Process

Automation Influences Staffing and Market Expansion

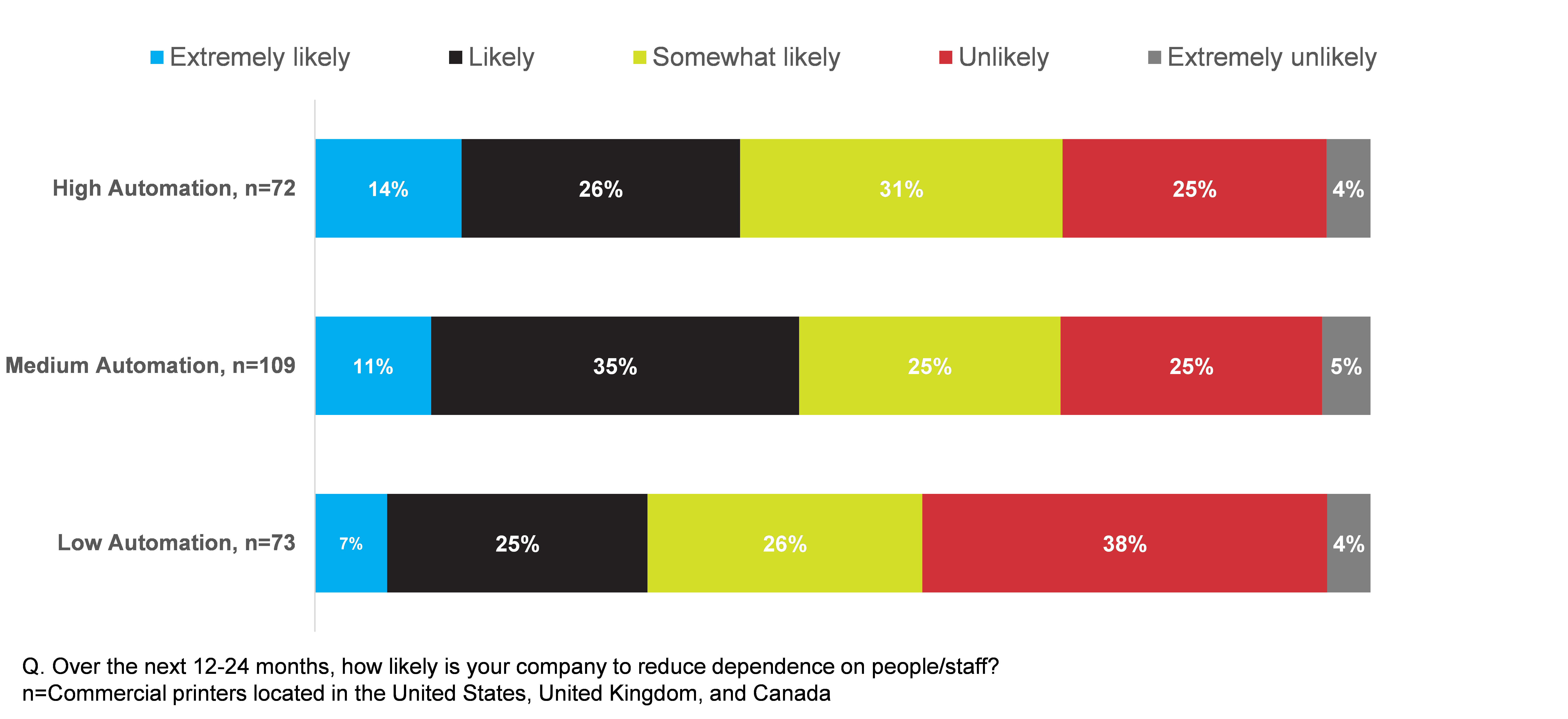

Automation isn’t synonymous with staff reduction, but it does aim at taking human touches and errors out of production routines where they don’t need to be. Not surprisingly, low-automation firms anticipate difficulty in reducing dependency on people and staff this way – 42% said that accomplishing it would be unlikely or extremely unlikely (Figure 13).

In contrast, the percentage of highly automated firms that said reducing dependency would be extremely likely (14%) was twice that of low automation firms (7%). The message for firms seeking to rationalize the workforce is that automation isn’t just about equipment – it is a key ingredient of efficient human resources management as well.

Figure 13: Likelihood of Reducing Dependency on People/Staff

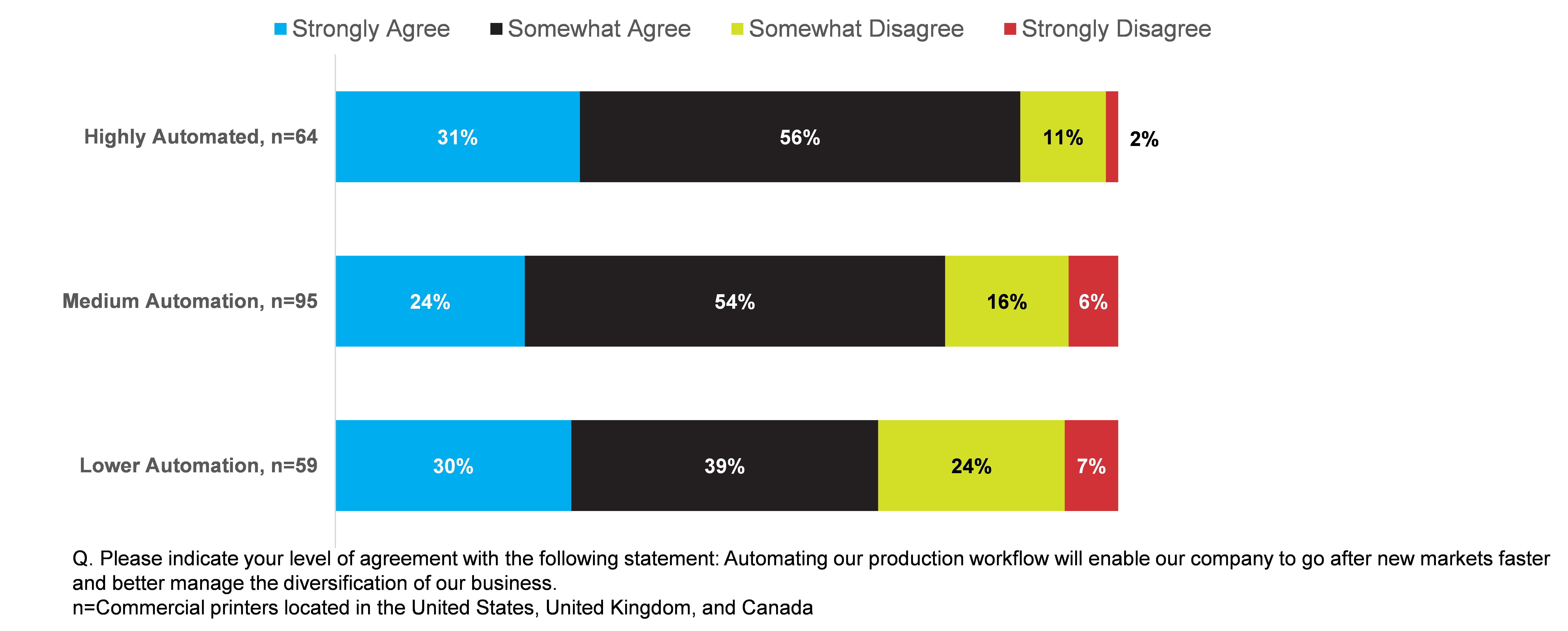

The more automated a printing business is, the better prepared it will be to develop new product applications for markets where it wants to achieve a bigger presence. Not surprisingly, high-automation respondents voiced the most confidence in this idea, having seen it in action in their own operations. By increasing their commitment to automation, other businesses can gain the same experience and level of confidence as the automation leaders.

Figure 14: Automation Supports Market and Product Expansion

FACTORS CREATING BOTTLENECKS

A bottleneck is a choke point in the production workflow that obstructs the throughput of job volume. Bottlenecks can happen when equipment breaks down or when an external event (for example, a power outage) interrupts the production sequence. Most of the time, however, bottlenecks are the result of ongoing but subpar manufacturing routines – a condition that workflow automation can cure.

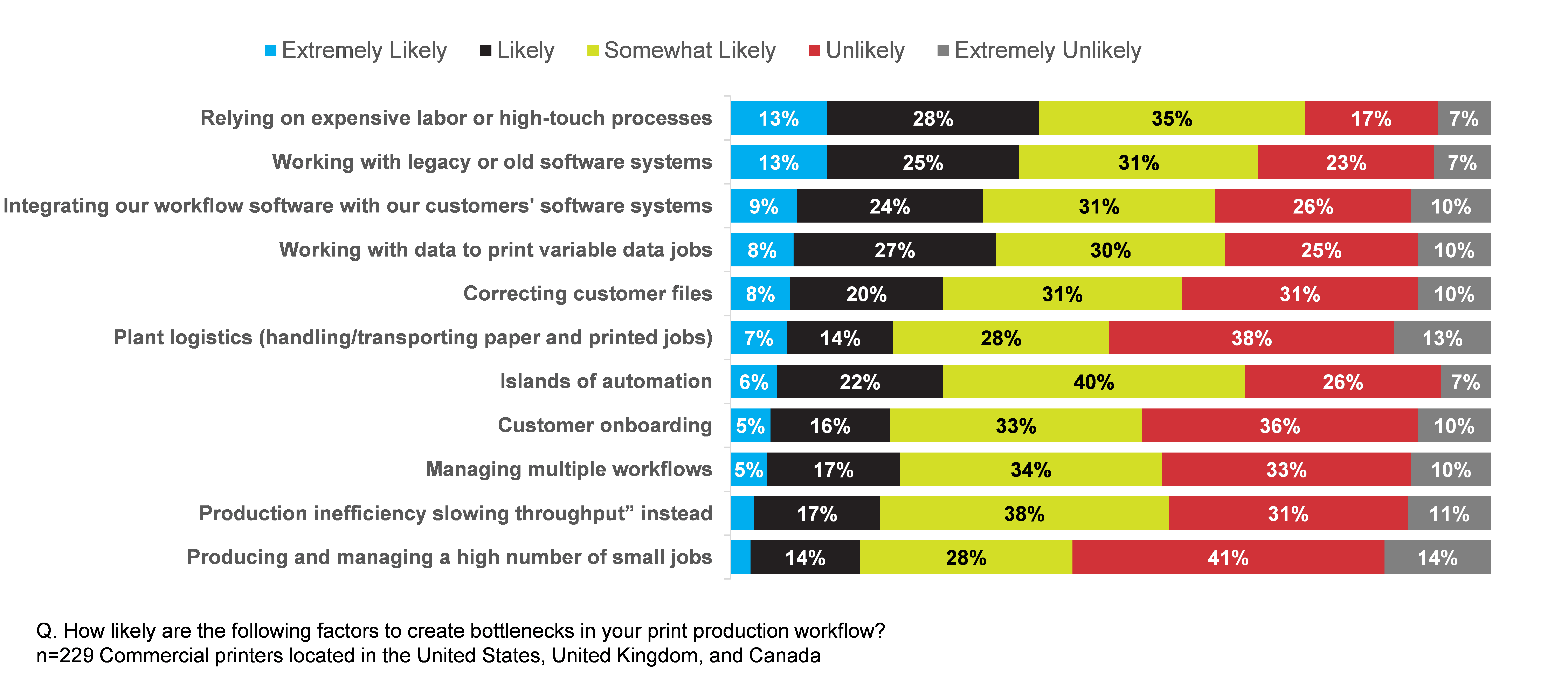

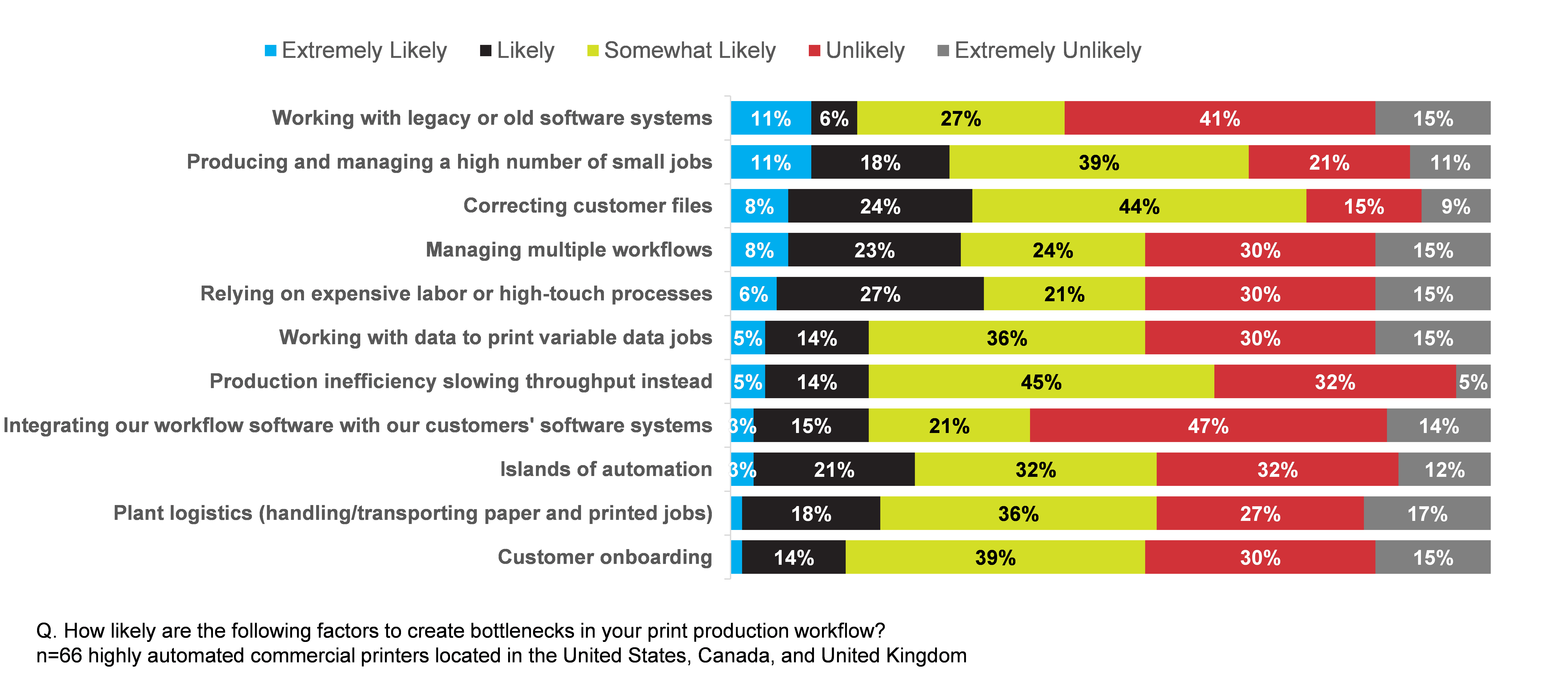

Respondents at all levels of automation were asked to consider situations that might create bottlenecks in their printing plants. The factor seen as most potentially problematic was relying on expensive labor or high-touch processes, identified by 76% of respondents as extremely likely, likely, or somewhat likely to be the cause (Figure 15). Given that reducing labor expense and eliminating needless touches are exactly what workflow automation is meant to accomplish, this finding alone underscores the wisdom of adding more automation wherever the need for it exists.

Figure 15: Factors Creating Bottlenecks

Shops Learn to Cope

Also noteworthy was that 55% said producing and managing a high number of small jobs was either unlikely or extremely unlikely to create bottlenecks. This indicates that the industry is learning how to cope with the decline of long runs and the rise of on-demand production in small quantities. Plant logistics, rated by 51% as unlikely or extremely unlikely to create bottlenecks, and customer onboarding (46%) are other areas where printers are demonstrating their adaptability to changing patterns of demand.

Automation is helping to make all of this possible, but as subsequent data will show, the benefit is always in proportion to the level of automation achieved. Bottlenecks will continue to impact production at insufficiently automated plants – until they take the obvious step toward breaking them.

Factors Creating Bottlenecks for Highly Automated Firms

The factor with the highest percentage of selection (76%) by respondents at high-automation firms as an extremely likely, likely, or somewhat likely source of bottlenecks was correcting customer files (Figure 16). The next-highest shares of response went to producing and managing a high number of small jobs (68%); production inefficiencies slowing throughput (64%); islands of automation (56%); and plant logistics (56%).

Bottlenecks can occur at all levels of automation, but respondents from highly automated plants expressed the most confidence in their ability to deal with them. For example, 61% said that integrating their workflow software with customers’ software systems would be unlikely or extremely unlikely to cause bottlenecks. Better than half (56%) did not regard working with legacy or old software systems as a likely impediment – probably because the software these shops are running is fully up to date.

Figure 16: Factors Creating Bottlenecks – High Automation

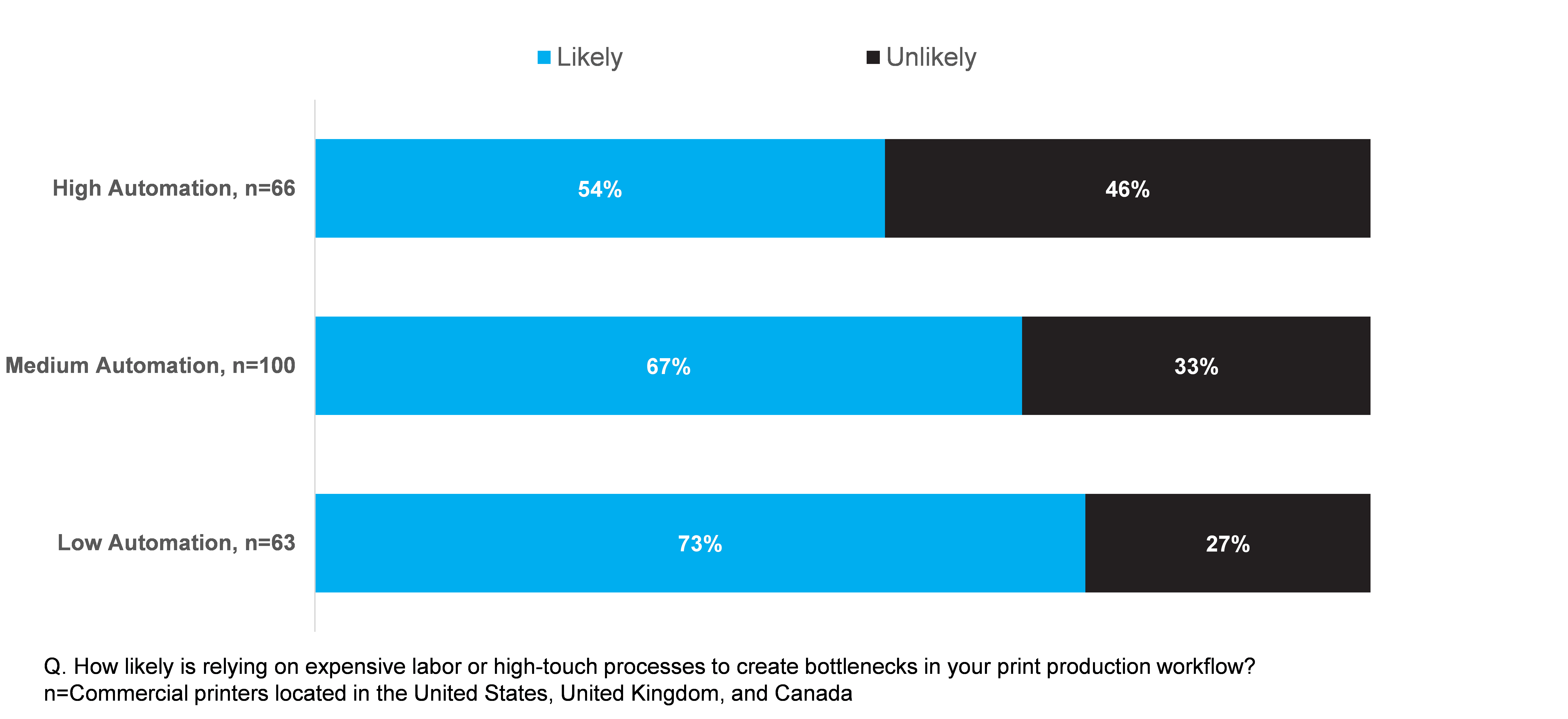

Even when indicating the likeliest sources of bottlenecks, fewer high-automation respondents cited these factors than members of the medium- and low-automation groups did. Figure 17 shows that relying on expensive labor or high-touch processes was called likely to cause bottlenecks by 54% of high-automation respondents; 67% of medium-automation respondents; and 73% of low-automation respondents.

Figure 17: Relying on Expensive Labor or High-Touch Processes

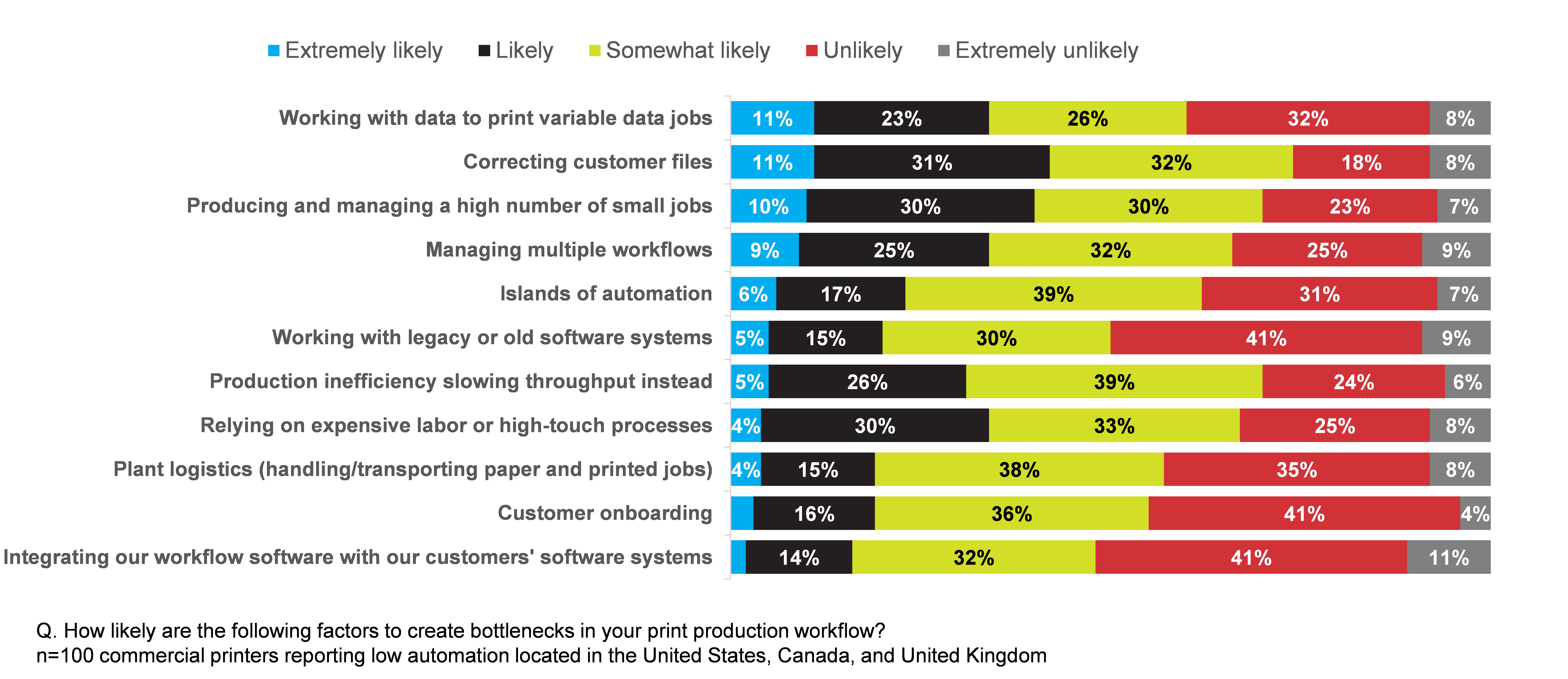

Factors Creating Bottlenecks for Firms with Medium Automation

As a group, medium-automation firms identify correcting customer files as their leading perceived source of bottlenecks, with 74% of these respondents calling it extremely likely, somewhat likely, or likely to result in them (Figure 18). This is followed by production inefficiency slowing throughput (70%); producing and managing a high number of small jobs (70%); relying on expensive labor or high-touch processes (67%); and managing multiple workflows (66%).

Figure 18: Factors Creating Bottlenecks – Medium Automation

In some cases, responses about bottleneck factors from medium-automation firms are close to those of high-automation firms; in others, they diverge. For example, almost as many high-automation respondents (68% vs. 70% medium-automation) saw a likelihood of bottlenecks in producing and managing a high number of small jobs. Only a slightly larger percentage of high-automation respondents (76% vs. 74% medium-automation) saw potential bottlenecks in correcting customer files.

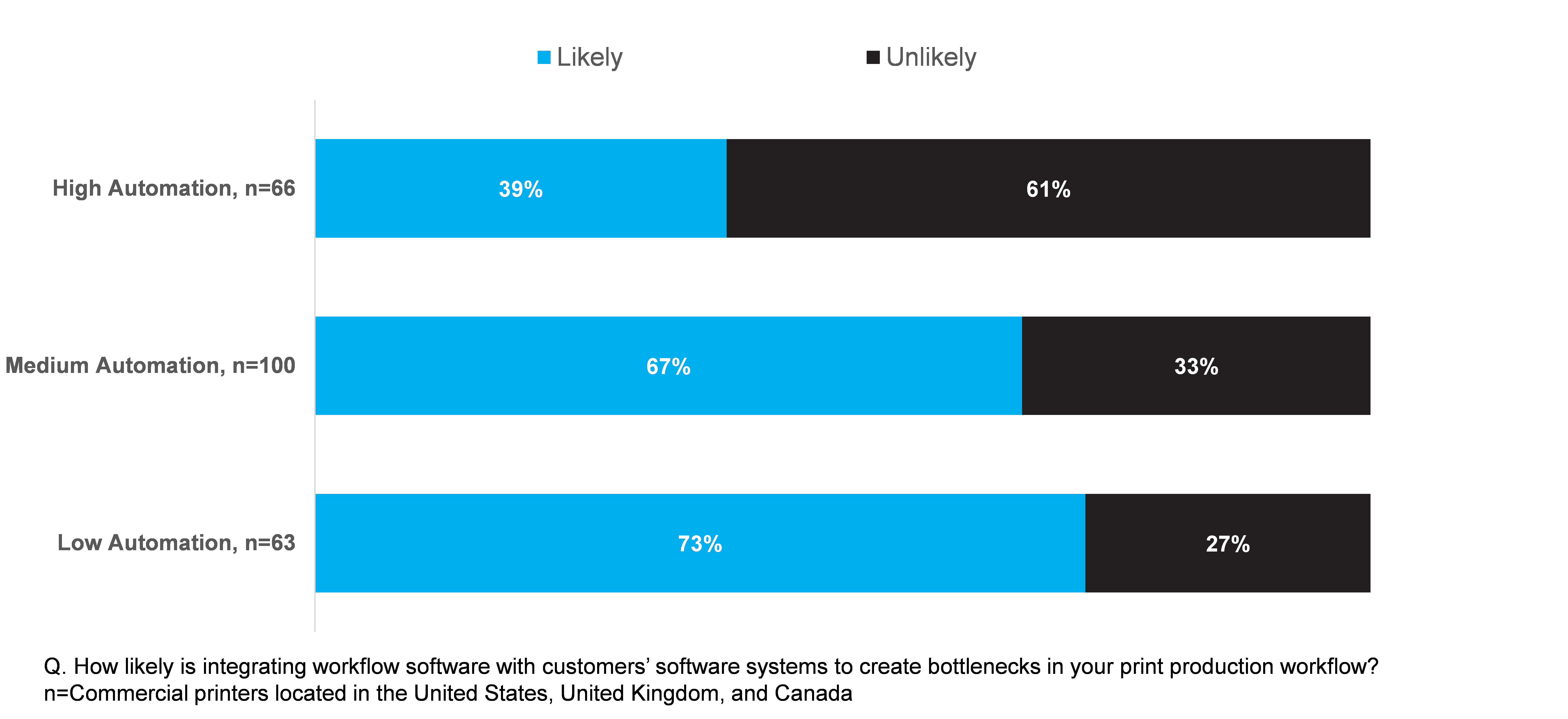

However, a more sizable share of medium- and low-automation respondents felt they were likely to encounter bottlenecks in integrating their workflow software with their customers’ workflow systems (Figure 19).

Figure 19: Integrating Workflow Software with Customers’ Software Systems

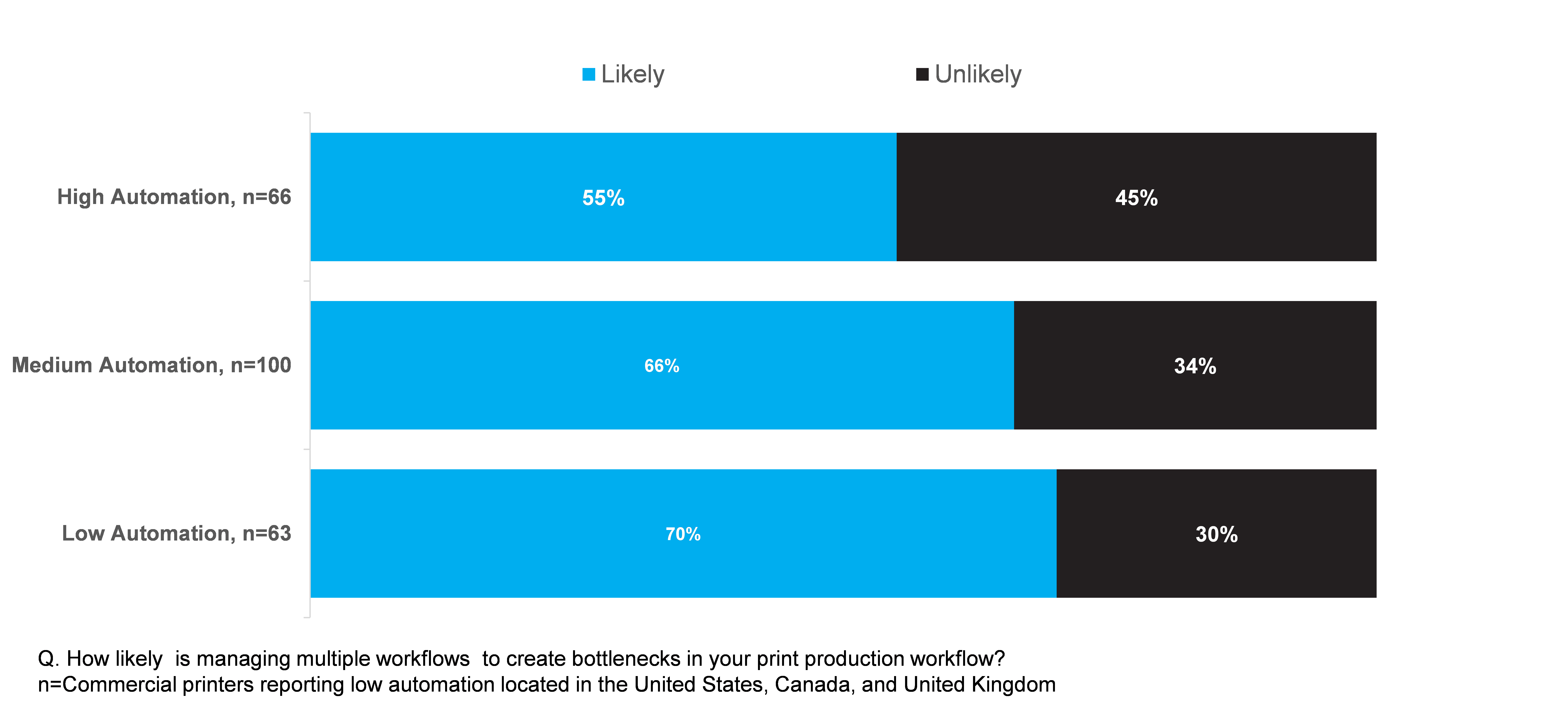

Managing multiple workflows also loomed larger as a potential bottleneck for firms with lower automation levels (Figure 20).

Figure 20: Managing Multiple Workflows

The feedback from the medium automation respondents suggests that they’re aligned fairly closely with their high-automation counterparts in the way they perceive and respond to production challenges. With further investments in automation, mid-range firms can move into the top tier of performance with less effort than they may realize.

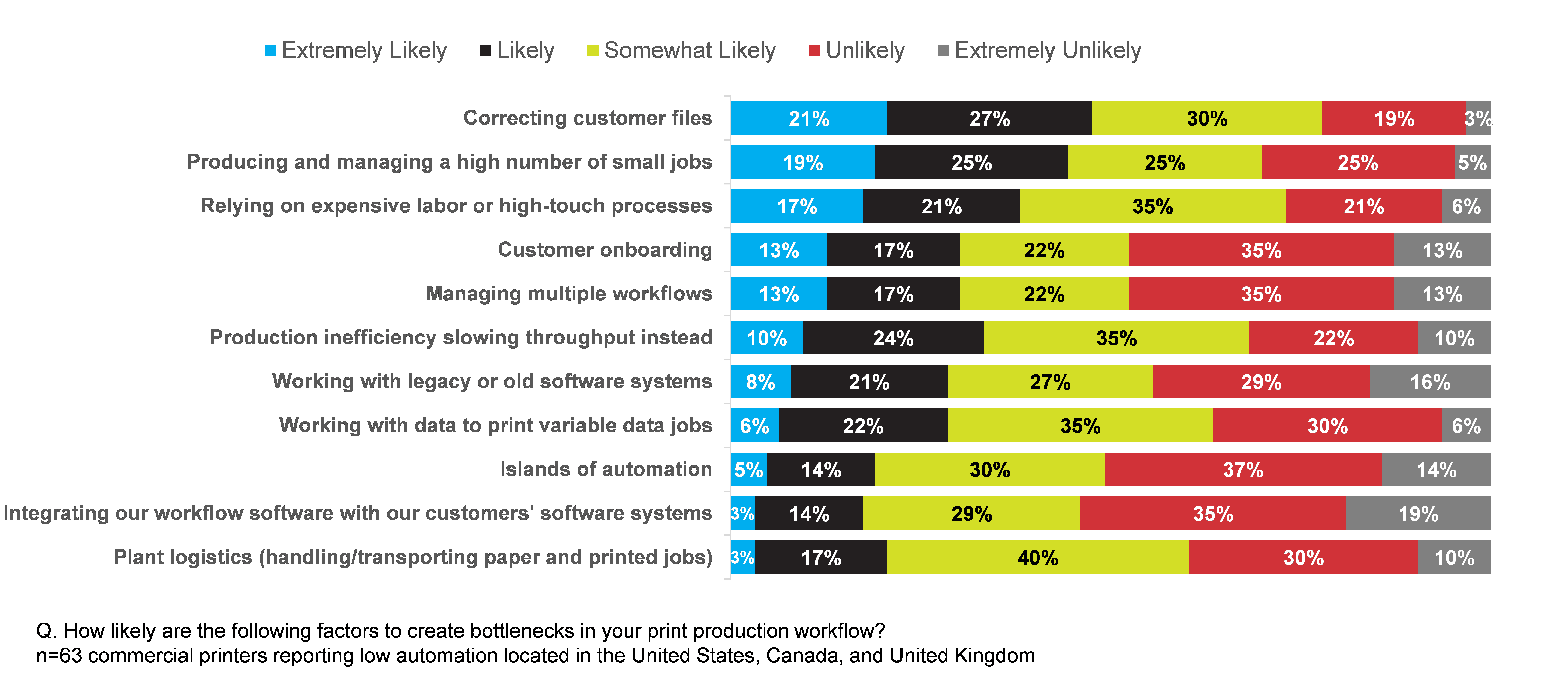

Factors Creating Bottlenecks for Respondents with Low Automation

Correcting customer files raises the strongest concern about bottlenecks for respondents reporting lower levels of automation, with 78% of respondents in this category calling it extremely likely, likely, or somewhat likely to lead to problems (Figure 21). Next in order of concern are relying on labor or high-touch processes (73%); producing and managing a high number of small jobs (69%); production inefficiency slowing throughput (69%); and working with data to print variable data jobs (63%).

Figure 21: Factors Creating Bottlenecks – Low Automation

Question of Proportion

The survey found that in general, the perception of difficulty from bottlenecks is inversely proportional to level of automation: the more automation that respondents said they had, the less prone they were to see bottleneck-producing factors as likely to slow their operations down.

For example, when queried about relying on labor or high-touch processes, a smaller share of high-automation respondents (54%) cited it as a likely bottleneck than low-automation respondents (73%). Similar differences are seen in the two groups’ responses about working with data to print variable data jobs (55% vs. 63%); working with legacy or old software systems (44% vs. 56%); and integrating the plant’s workflow software with customers’ software systems (39% vs. 46%).

Inhabiting the ‘Islands’

In an interesting reversal of this trend, however, more high-automation respondents than low-automation respondents (56% vs. 49%) said they saw islands of automation as likely sources of bottlenecks. Part of the explanation may be that by definition, low-automation firms have fewer instances of automation to think about than high-automation firms. The latter group, more attuned to making the best use of the automated resources they have, are therefore more sensitive to situations where execution is falling short of what they expect.

Low-automation firms can achieve the same level of awareness by pinpointing where their bottlenecks are coming from and using automation to eliminate them. The next section presents the bottlenecks that respondents say they actually have encountered in their day-to-day operations.

The conclusion is plain: by breaking bottlenecks with the help of automation, printing firms can realize their full potential as manufacturing businesses.

BOTTLENECK AREAS VARY BY LEVEL OF AUTOMATION

The good news is that there’s a big difference between the perceived risk of bottlenecks and the number of times printers actually experience them. The risks are ever-present, but automation is what keeps them from turning into production stoppages.

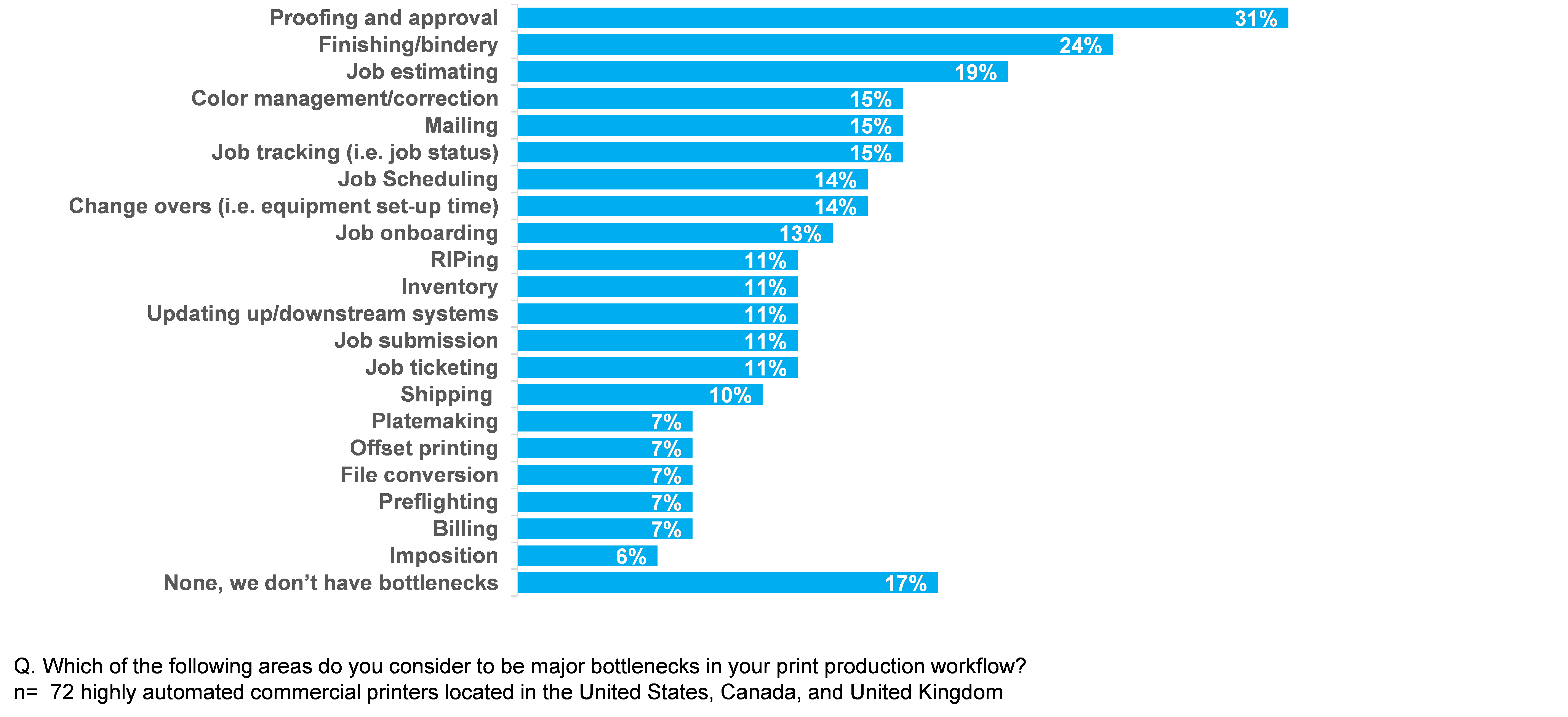

Proofing Key Bottleneck for Highly Automated Firms

Top areas for production bottlenecks for highly automated respondents are proofing and approval and finishing/bindery (Figure 22), as both tend to be more automation-resistant than other parts of the workflow.

Figure 22: Bottleneck Areas – Highly Automated

This is true of proofing and approval because the latter half of this process takes place outside printers’ control, with customers setting the pace of print OKs. Finishing and binding can be challenging to automate because postpress tasks continue to involve more physical labor than prepress and printing. Still, fewer respondents from high-automation firms identified these two areas as major bottlenecks than respondents from medium- and low-automation firms.

Nearly one in five (19%) of high-automation respondents reported encountering bottlenecks in job estimating, perhaps reflecting the highly diversified nature of commercial print work. After that, however, the frequency of bottlenecks drops to low double- and single-digit percentages for these firms – a testament to how often automation keeps them out of situations that would otherwise slow them down.

Interestingly, 17% of respondents from highly automated companies report their organizations do experience production bottlenecks.

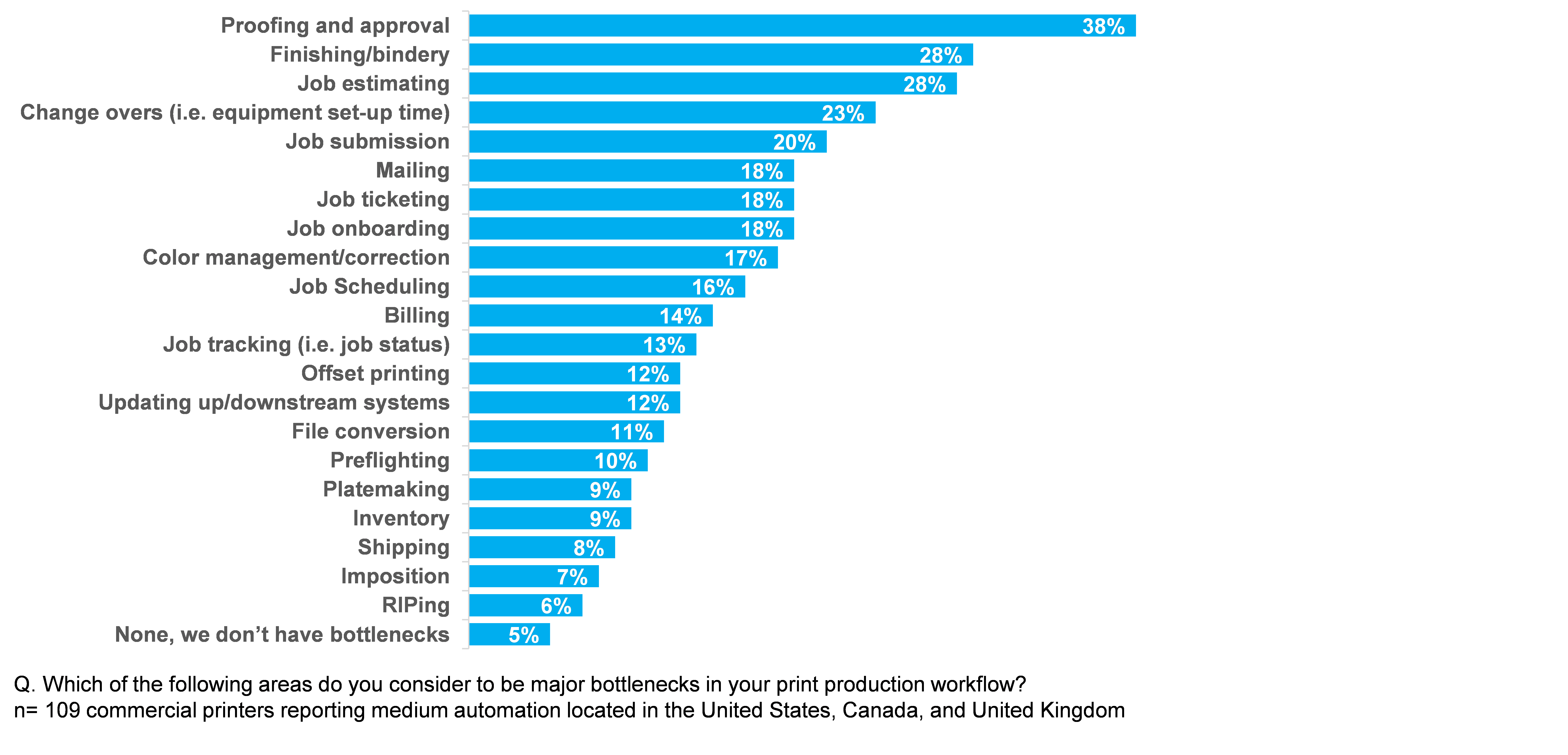

Job Management Obstacle for Medium Automation Respondents

Among respondents from medium-automation firms (Figure 23), the percentages in most of the categories start to creep up, most notably in proofing and approval (38% for medium-automation firms, vs. 31% for high-automation firms; job estimating (28% vs. 19%), and equipment setup time in changeovers (23% vs.14%).

Respondents in this group also reported running into more issues with job submission and job ticketing than their high-automation counterparts.

Figure 23: Bottleneck Areas – Medium Automation

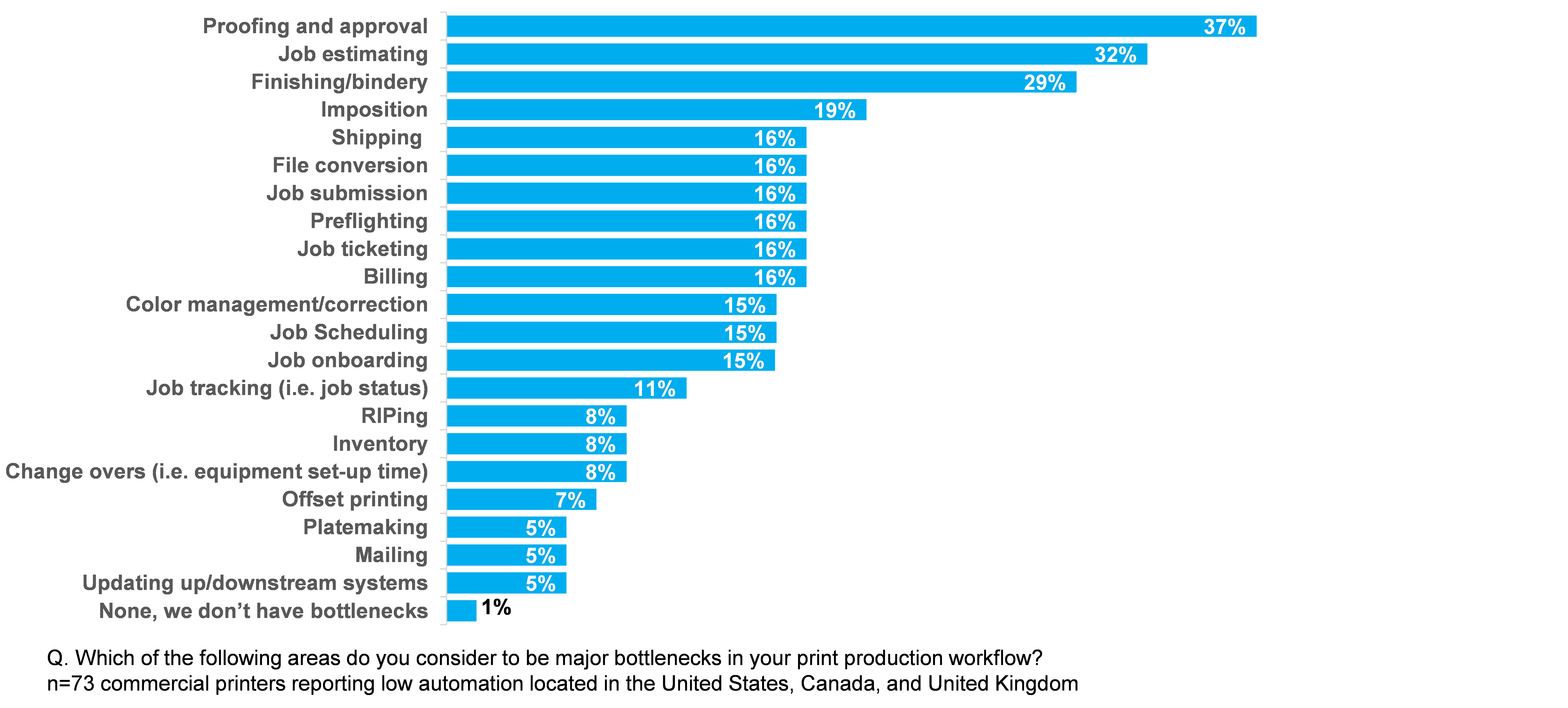

More Choke Points in Company’s with Low Automation

Despite some unexpected findings – for instance, that just 8% of the low-automation group considered equipment changeovers a bottleneck, versus 23% of medium-automation and 14% of high-automation respondents – the survey showed this cohort to be more deeply stuck in various workflow choke points than the other two (Figure 24).

Figure 24: Bottleneck Areas – Low Automation

For example, imposition – a prepress task first automated by software more than 30 years ago – was cited as a major bottleneck by 19% of low-automation respondents, in contrast with 7% of the medium-automation group and 6% of those in the high-automation category. Also on the prepress side, shops with low automation encountered more difficulty with the readily automatable tasks of file conversion and preflighting.

A shortfall in automation doesn’t inevitably translate into problems for shops that have limited their investments in workflow systems and software. But, holding back investment means holding back growth potential – a mistake that no printing business can afford to make in an environment where growth and profit increasingly belong to the most efficient producers.

CONCLUSION

A resounding observation from the research is that workflow automation is a necessity. Print automation supplies the momentum for the printing industry’s natural evolution toward the data-driven, interconnected, autonomous manufacturing routines of Industry 4.0. In everyday terms, it’s a practical solution for gaining more efficiency, getting more work done, and making more money. Automation is no longer optional for any firm that expects to survive in today’s ultra-competitive commercial printing market. Automation is a golden opportunity for every print service provider that wants to prosper in it.